So, you’ve got a teen driver

Teen drivers

Insurance is a necessary cost in today’s world. The law requires auto insurance, and a mortgage company requires home insurance. It is impossible to argue the value that insurance adds to the country. By paying a fee every year, the insurance company will cover you in case of disaster. That being said, sometimes the premiums can jump up for one reason or another. Maybe you have had a lapse in insurance, or filed several claims in the past few years; or perhaps you’ve added a young driver

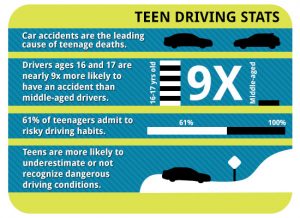

Why would teen drivers be more expensive than any other driver? Just take a look at the statistics:

You read that correctly; drivers aged 16 or 17 are up to nine times more likely to have an accident while on the road than a middle aged-driver. The fact is, teenage drivers take more risks when they’re on the road. Often, they are in a hurry to get where they’re going. They’ll speed up to get through the light, pull out in front of another car, or use their phone while the vehicle is in motion.

Of course, this is not a fair indictment of all teenage drivers. You may have a child or know someone whose teen has never been in an accident, and may not be anytime soon. The fact is, industry statistics show that until drivers are around the age of 24 or 25, they are most likely to cause an accident. Hence, premiums are high.

How can I reduce my premium?

How to keep premiums down for a young driver:

- Good Student Discount

- If your teenage driver has a “B” average or better in school, whether at the high school or college level, they may qualify for a good student discount. Nearly every company has a form of this discount, and it can be as much as a 10% discount off the premium for the vehicle your student drives. This discount may be added, in many cases, until the driver is over the age of 22.

- Resident Student Discount

- A slightly different discount than the Good Student Discount is the Resident Student Discount, which applies to students who are 100 or more miles (depending on the specific company) away at school and without a vehicle. Again, this can usually be added until a student is over the age of 22 and is a fairly significant savings on the premium. The implication is that the teen is not driving any cars on the policy unless he or she is home from school.

- Teen driving programs (company specific – ask your agent for more details)

- Many companies offer different programs for youthful or teen drivers that will offer a small discount on the auto insurance policy. These can include classes, online or in person, to teach young drivers about the danger of distracted driving and how to stay safe on the road. Often these are not as large of discounts as the previous two examples, and they vary from carrier to carrier.

As always, you should discuss this subject with your agent or service representative when someone is being added to the policy. They can help prepare you for what to expect and perhaps try moving your account to find more favorable premiums for your youthful drivers.

Eckburg Insurance Group is the largest home and auto insurance provider in northern Illinois. We can cover all your home, auto, business, and life insurance needs. Our dedicated staff, made up almost entirely of men and women who were raised in our community, works tirelessly everyday to keep you protected. Call us today at (815) 877-4100 or click here for a quote!